Risk Assessment On Demand

As service providers, you need risk assessments of your clients under the AML and for performing work. Many times you do not have the right tools and the necessary knowledge and skills to perform them. You want to do business securely by determining who you are doing business with. You also need to comply with the requirements of the AML.

Through the CDD web version it is possible to view CDD in your browser. This makes it easy and fast to meet the requirements from the AML and Sanctions Act.

Risk assessment of your clients

We understand better than anyone that the AML gatekeeper function is seen as a distraction from the real work. Customer Due Diligence is a profession, we know that from experience. Together with our clients and partners, we have created a solution for you.

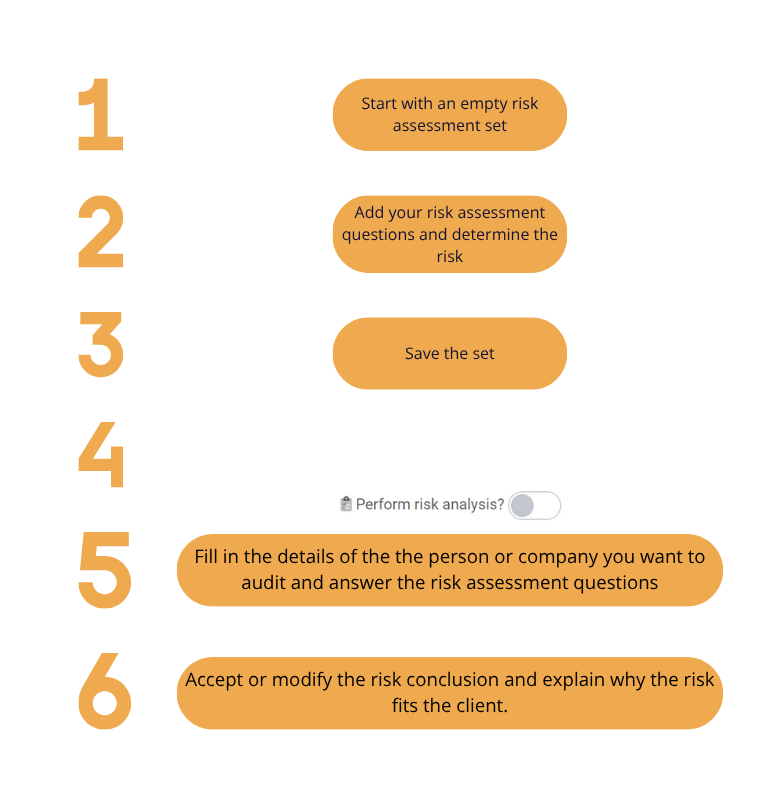

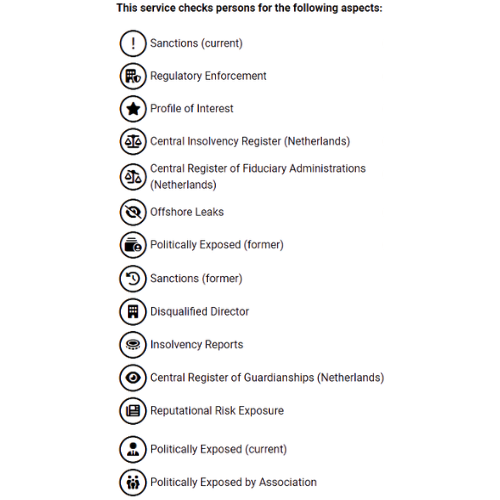

Central to our solution is the client screening report in which all necessary compliance checks are performed. After entering a name, date of birth, and nationality, this report can be requested. The client screening report can also be provided with a risk assessment based on your own risk policy. Your own risk assessment determines whether you can do business responsibly with the relationship.

If you would like to know more about AML compliant safe business, you can request a trial account.

Establishing and implementing a risk policy with our solution leads to safer business and AML compliance. All in all, using our products reduces your risks of reputation and image damage and prevents fines from the financial authorities.

This distracts from your daily activities, which is why you need help to comply with the AML. We are happy to help you so you can focus on your clients. Experience for yourself how much time you can save?

Then quickly request a trial account.

Conducting a client screening will help you get to know your client better. Before executing a transaction or (intermediary) assignment, entering into a business agreement, or providing services to your client, you should screen your client.

Here, for example, you must establish, verify, and record the identity of the client and/or UBO and verify whether the client is acting for himself or herself or for someone else and also be able to monitor this on an ongoing basis.

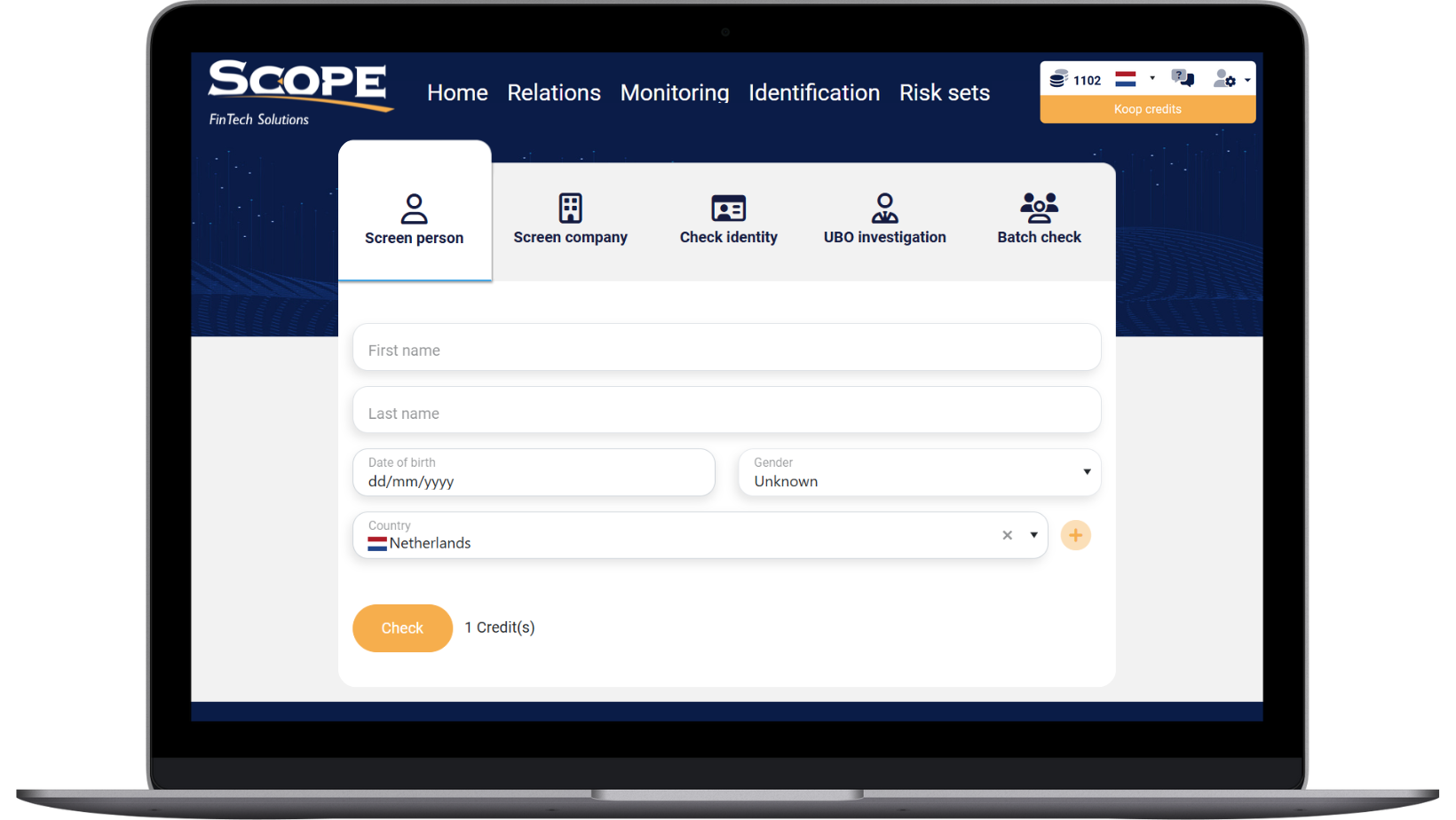

Step 1

Enter your client's name, date of birth and country or company information.

Step 2

Start the online client screening.

Step 3

Receive a certified report with the results as proof of the survey conducted.

Step 1

Enter your client's name, date of birth and country or company information.

Step 2

Start the online client screening.

Step 3

Receive a certified report with the results as proof of the survey conducted.

Read previous experiences of our clients and partners here.