Anyone who works with AML wants speed without compromise. A complete file without detours. And a customer journey that continues, even when checks are rigorous. SCOPE's CDD API is built to deliver exactly that. Not by adding extra steps, but by making your existing process smarter. Identification, PEP and sanctions, UBO and risk signals come together in a single line within your own systems. Your team works with certainty. Your auditor receives clear substantiation. You get peace of mind.

Organizations that choose technology are in fact choosing predictability. You want every customer to follow the same careful path. You want an explanation for every finding and an audit trail that raises no questions. That's where SCOPE excels. Decision rules are easy to manage. Every check is fully traceable to its source. Discussions become shorter. Time wasted disappears. Energy is directed towards the customer, not towards separate lists.

Why our API?

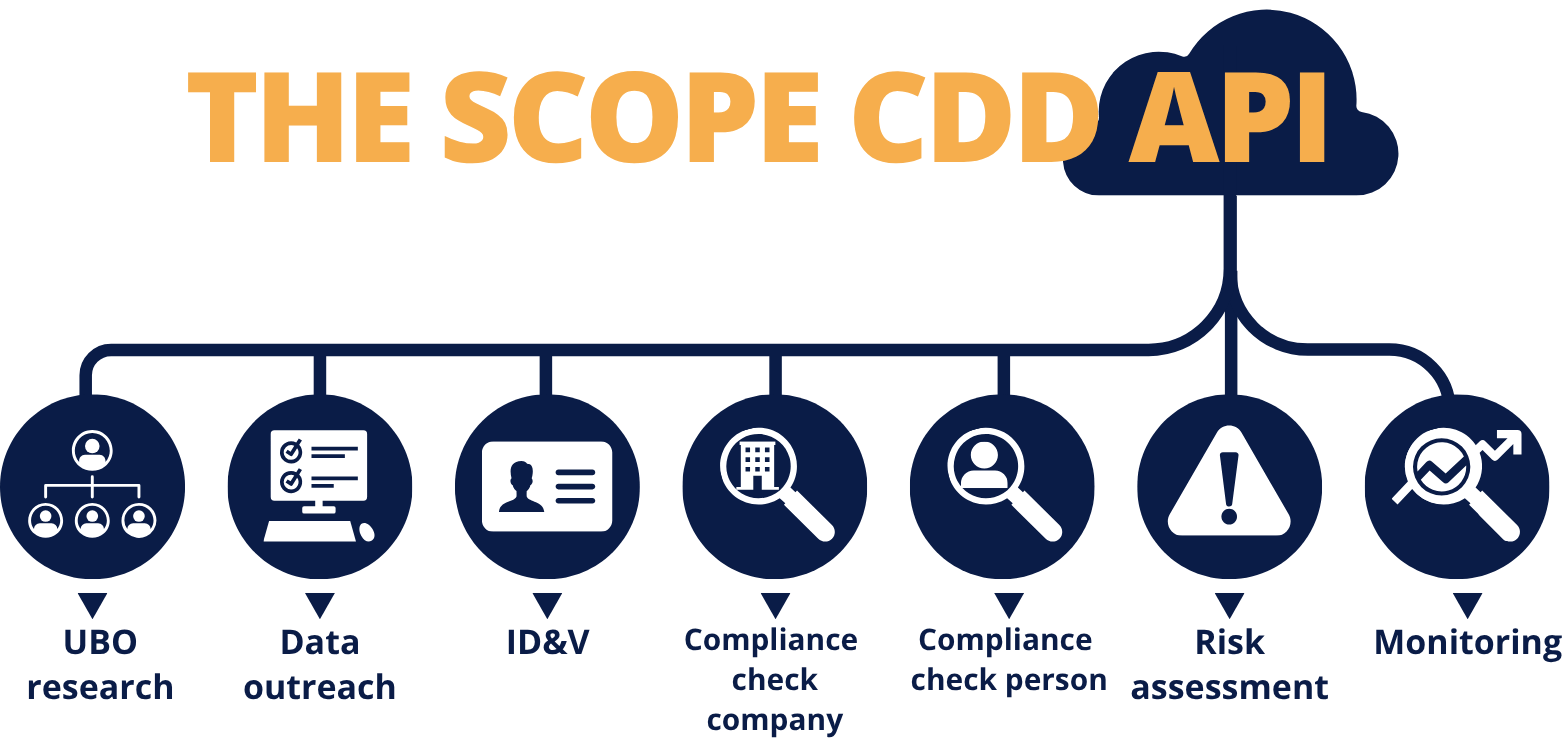

- Always up-to-date customer research: Always up-to-date data thanks to real-time links to registers and sanctions lists.

- Seamless integration into your software: CDD functionality directly available within your own product (CRM, onboarding tool, or accounting package).

- Clear license + pay-per-use model: A fixed license price combined with pay-per-use – transparent and scalable.

- Time savings and lower costs for your users: Conduct customer research faster and automate review processes, with fewer manual steps.

- Report in one place: All reports, customer profiles, and documentation stored centrally in your environment.

CDD API in practice

Schedule an introductory meeting

Schedule a no-obligation introductory meeting today. Together, we will look at how our CDD API can support your organization.