How do you ensure that customer files are not only complete, but also fully compliant with the latest laws and regulations?

At SCOPE FinTech Solutions, we approach remediation with a fresh perspective: not as a mandatory task, but as an opportunity to improve your processes, reduce risks, and enhance your customer experience.

Whether you work with thousands of files or a select portfolio, our platform helps you to remain fast, efficient, and compliant.

What is remediation?

Remediation is the process of reassessing and updating existing customer files. This is necessary when laws and regulations change, when risk profiles change, or when customer data proves to be incomplete or outdated. Examples include missing UBO information, expired identity documents, or changed company structures.

For many organizations, remediation is a time-consuming and error-prone process. SCOPE changes this with smart automation, customer-friendly communication, and complete audit trails.

How remediation works in SCOPE

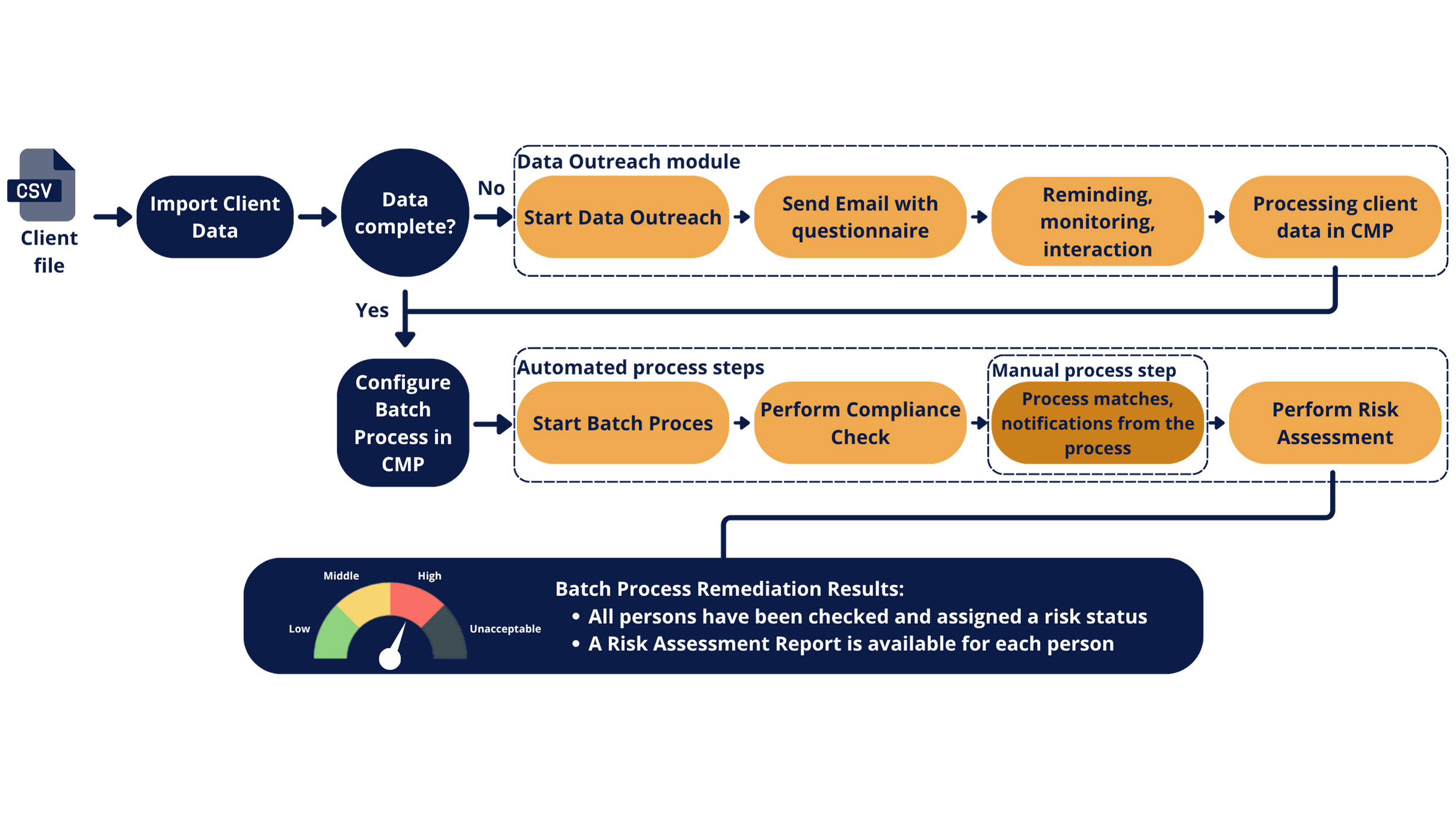

1. Importing customer data

The process begins with importing customer data via a CSV file.

2.1. Is the data incomplete? Then Data Outreach kicks in

If any data is missing, the Data Outreach module is activated:

- Customers get an email with a questionnaire.

- Reminders and interactions are tracked.

- As soon as the missing information is provided, it is processed in the CMP.

This step ensures that compliance teams do not waste time on manual follow-up and that customers can quickly and easily complete their data.

2.2. Is the data complete? Then the batch process starts

Once the data is complete (via import or after Data Outreach), the batch process is configured in the Compliance Management Platform (CMP). This consists of:

- Performing compliance checks (such as sanctions lists, PEP checks, etc.)

- Handling matches and notifications from the process

- Performing risk assessments

3. Results and reporting

After processing:

- Are all persons involved assigned a risk status (e.g., low, medium, high, unacceptable)?

- Is an individual risk assessment report available for each person?

- Is everything logged in a complete audit trail, ready for internal control or external audits?

Why is this important?

A well-designed remediation process is essential for any organization that is subject to financial supervision. But it also offers concrete benefits:

- Efficiency: Less manual work, faster turnaround time

- Scalability: Suitable for both small and large customer bases

- Compliance: Complies with AML, sanctions legislation, and internal audit requirements

- Customer-focused: Smart communication and reuse of data ensure minimal friction

Ready to improve your remediation process?

Would you like to know how SCOPE can help your organization with remediation? Contact us for a demo.