Welcome to SCOPE Fintech Solutions and our world of next generation KYC/CDD solutions. At SCOPE we have one mission and that is to help our partners and customers comply with AML regulations by providing them with state-of-the-art software tools to improve the quality, efficiency and customer experience and reduce compliance costs.

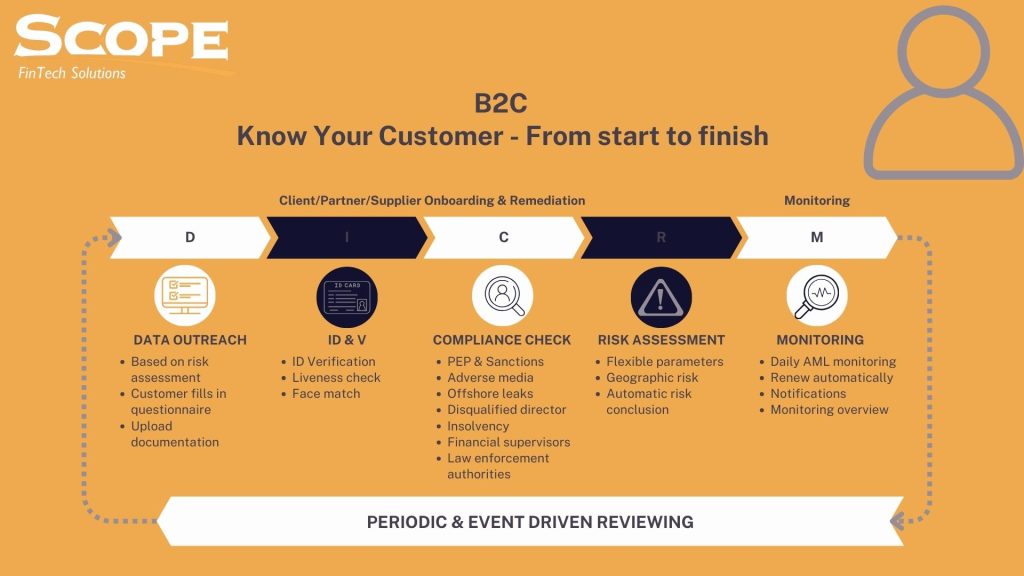

Being in control of AML compliance is all about managing the client’s life cycle from the onboarding stage, guarding and monitoring, performing reviews, until the client offboards. SCOPE Fintech Solutions can provide a software solution for the entire process and life cycle with our Compliance Management Portal or we can provide software components to integrate AML into an existing process or system via the CDD API.

No matter what type of relations you do business with, our software covers performing a client investigation and risk assessment for natural persons in a business to consumer situation as well as for organizations in a business to business environment.

Being in control of AML compliance is all about managing the client’s life cycle from the onboarding stage, guarding and monitoring, performing reviews, until the client offboards. SCOPE Fintech Solutions can provide a software solution for the entire process and life cycle with our Compliance Management Portal or we can provide software components to integrate AML into an existing process or system via the CDD API.

Maak CDD nog makkelijker, integreer CDD-controles direct in uw eigen software omgeving. Of maak gebruik van een van de oplossingen van onze partners waar de CDD controles al in geïntegreerd zijn. Download hier de brochure.

With our knowledge and data partners, we have developed the right tools for KYC departments to make your risk assessment process faster, more efficient, and more interesting for employees. Read the benefits in our brochure.