Wwft Compliant zakendoen

Met wie kan u veilig zakendoen?

Aan de wwft voldoen: verschillende software-oplossingen

Onze compliance-oplossingen kunt u op 3 manieren raadplegen: via uw eigen SCOPE Compliance Management Portal, direct in uw eigen software of direct starten via de webbrowser.

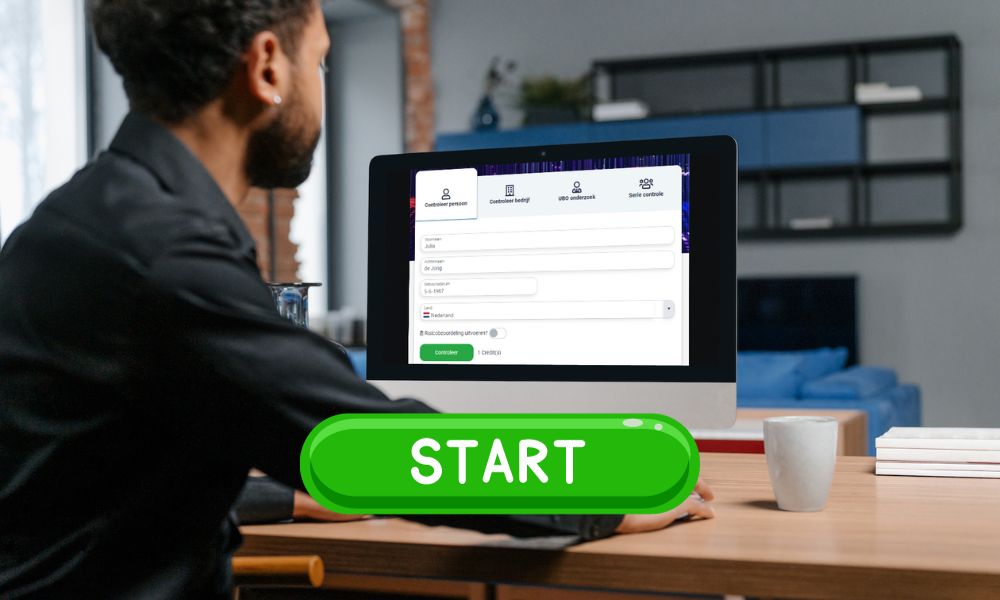

SCOPE compliance management portal

Werkt u met meerdere gebruikers of afdelingen aan compliance dossiers? Het SCOPE Compliance Management Portal biedt een oplossing voor een digitale vertaling van uw risicobeoordelingsbeleid. Werk met meerdere gebruikers en geavanceerde functies en functionaliteiten om uw CDD- proces op te lossen.

Compliance In uw eigen software

CDD controles direct in uw eigen software omgeving uitvoeren? Dan kunt u SCOPE CDD integreren in uw eigen software middels de SCOPE CDD API.

Direct starten via de webbrowser

Snel starten en direct een antwoord nodig? Dan is SCOPE CDD On Demand de oplossing voor u. Geen implementatie maar direct starten met het uitvoeren van controles.

Onze CDD-oplossingen:

- Maken de uitvoering van het CDD proces sneller, besparen tijd en geld en voorkomt fouten.

- Verbeteren de kwaliteit van de risicobeoordeling door eenduidigheid en uniformiteit.

- Maken het werk van de CDD analisten interessanter door gerichte inzet op risicoclassificaties.

- Zijn ontwikkeld op behoeften van de markt en de wetgevingseisen; flexibel qua opzet en snel productief te maken in een veilige Microsoft Azure Cloud-omgeving.

Lees hier eerdere ervaringen van onze klanten en partners.